|

WORKING PAPER

Preparing for the Economic Boom

|

|

Patterns from the Past

A boom is upon us. The economic indicators are loudly positive. Consumers are awash with funds from pandemic-induced savings and government stimulus checks. Many businesses are cash-rich and hungering for growth. Everyone is euphoric with post-Covid freedoms. It’s a perfect storm of positivity. We can’t know how long it will last, but we can be certain it will transform the fortunes of companies ready for this moment. How can you prepare?

LESSONS FROM THE LAST BOOM

As specialists in the dynamics of rapidly changing industries, we look for inspiration not just in the present but in the past. An obvious touchstone for the current moment is the boom of the 1990s. There are of course differences – for instance, it was fueled largely by the advent of the internet and tech investment, and it took longer to gather momentum—but the parallels provide useful guidance. Six lessons from the 90s are significant for the present:

A boom is upon us. The economic indicators are loudly positive. Consumers are awash with funds from pandemic-induced savings and government stimulus checks. Many businesses are cash-rich and hungering for growth. Everyone is euphoric with post-Covid freedoms. It’s a perfect storm of positivity. We can’t know how long it will last, but we can be certain it will transform the fortunes of companies ready for this moment. How can you prepare?

LESSONS FROM THE LAST BOOM

As specialists in the dynamics of rapidly changing industries, we look for inspiration not just in the present but in the past. An obvious touchstone for the current moment is the boom of the 1990s. There are of course differences – for instance, it was fueled largely by the advent of the internet and tech investment, and it took longer to gather momentum—but the parallels provide useful guidance. Six lessons from the 90s are significant for the present:

|

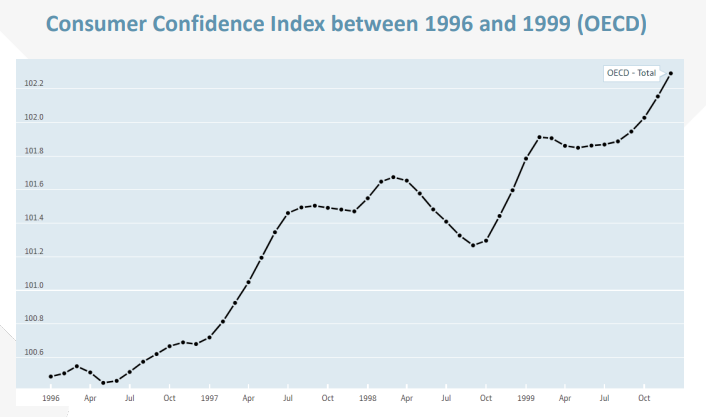

CONFIDENCE CREATES A FEEDBACK LOOP Tech investment in the 90s lifted consumer incomes, which ricocheted into other corners of the economy. Both businesses and consumers began to invest more in capital expenditures as well as more immediate consumption, confident that the tide would continue to rise. And this spending fueled still further increase of fortunes as money circulated. Firms positioned to capitalize on this spending did quite well. |

PLAN AHEAD FOR HOW BOOMS MAY LEAD TO SHORTAGES

As the economy gets hot, not all sectors can keep up. In the 90s, there were acute shortages of IT labor, for instance. Firms dependent on fragile supply chains could face challenges getting a reliable allocation of resources. It paid to have a handful of formulas for growth if your go-to method was supply-constrained.

“BUILD IT AND THEY WILL COME ” STILL DOESN'T WORK DURING A BOOM

Due to strong confidence and a feeling that riches had to be grabbed quickly, many firms attempted to build totally new propositions super-fast, without planning for resiliency in case of industry changes. Usually, this did not go well. Even Amazon, the poster child of 90s success, had to undertake some major re-directions.

|

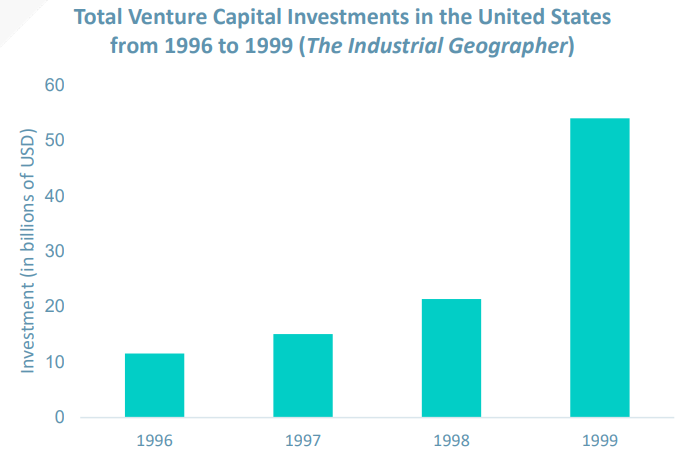

DISRUPTION HAPPENS EVEN FASTER IN A BOOM As both established companies and venture capitalists plowed money into this fertile soil, and as technological and social trends created new opportunities for businesses, the pace of disruption accelerated fast. The trend wasn’t confined to internet technology but extended to biotech, financial services, and far beyond. Threats and inspiration from these disruptors spurred further investment by incumbents to ride the trend and guard against its dangers. |

|

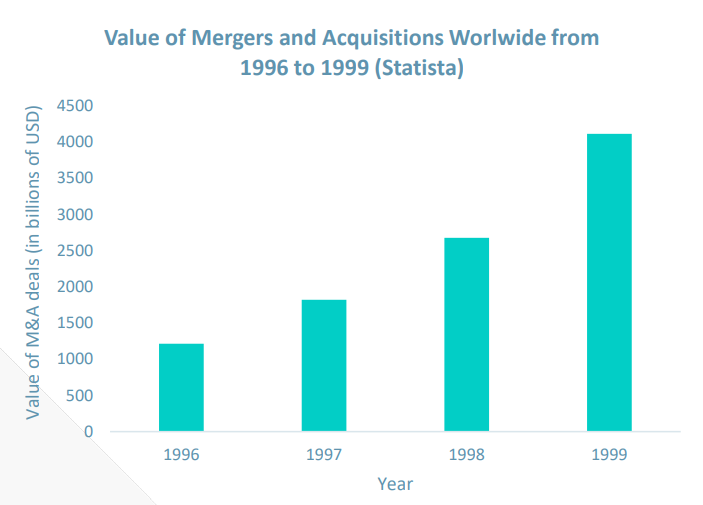

LOCK IN BOOM GAINS WITH ORGANIC GROWTH, NOT IMPULSIVE M & A ACTIVITY The 90s were a great time for M&A investment bankers. Firms swallowed each other in a seemingly ever-quickening pace as they sought to harness the growth some had captured. A large percentage of these deals fared poorly. Companies that instead invested concertedly in organic growth – both within and outside their core business – typically spent less money and often built more sustainably successful businesses. Think Microsoft. |

|

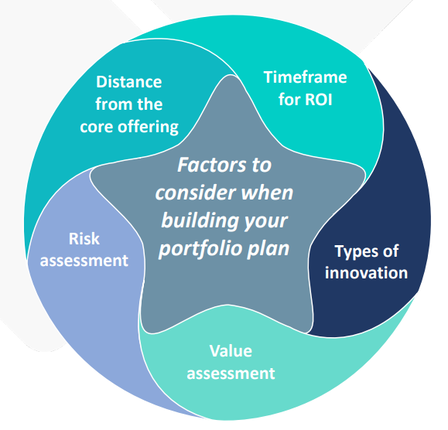

USE A PORTFOLIO PLAN TO PROTECT YOURSELF AGAINST INEVITABLE BUBBLES Speculative bubbles ballooned and eventually popped. In a frothy economy, investors – be they corporate or retail – often seek the one big trend to bet on. Given that the most obvious trends are clear to all, this creates unsustainable asset prices in some narrow categories. The winning companies had portfolio plans to spread their bets and thought carefully about the options they were creating, planning for where their industries would be in a few years’ time rather than just catching the strongest breeze of the moment. Compare Time Warner’s disastrous merger with AOL to Comcast’s series of smaller, more sustainable bets at the same time. |

Questions To Ask Your Business

Looking back on these lessons, what are the implications for your business? Below are several high-level questions to ask to spur further thinking about your industry dynamics.

- What will be the effects of flush business and personal spending? A burst of confidence is coming. What will people want to invest in? If they see our current time as ripe for taking on debt, what will that debt fund? Will people start trading up to less price-sensitive tiers of marketplaces? What then happens after some companies and individuals become over-leveraged?

- Where will shortages of skilled labor or supplies affect you? As the economy heats up, certain sectors will become overstretched. What are your key dependencies on them? Where in particular is skilled labor a potential constraint? What is Plan B for dealing with these impending shortages?

- What changes have the pandemic and other disruptions wrought on your growth opportunities? Your plan shouldn’t be made by looking mainly in the rearview mirror. What behavior changes from the pandemic will stick? How have competitive dynamics irreversibly shifted? How quickly will new approaches to business take hold? What do you really know about the future, and what are the unknown unknowns?

- How resilient are you to sudden changes and disruptions? My mentor, Clayton Christensen, coined the term “disruptive innovation,” but he didn’t expect our current times to be termed the Age of Disruption. Yet it is an increasingly used phrase, for good reason. The pace of industry upheaval keeps accelerating, not only in tech but in formerly staid fields from hotels to building supplies. What disruptions are on your horizon, and what are the signals that the gathering wave is about to crest? What about the effects of broader societal turbulence, from new global concerns to economic issues such as the quite-possible rise of inflation?

- How much should you invest in growth options, how broadly, and where? In the 90s, most companies lacked a portfolio plan for how to grow their business – what they should invest in organic vs. inorganic options, how much they should concentrate those bets, what payback periods were acceptable, and what sectors of their industry they should be focusing their investment in. They paid dearly for that lack of planning. What’s your plan?

LOOKING AHEAD… NEXT STEPS TO TAKE

1. Separate the facts from the assumptions

Determine what are clear trends, what you know you don’t know, and what categories of surprises may lie ahead. Too often, these threads get tangled together, but they have very different action implications. For instance, the surprises can be assessed through wargaming and other interactive exercises, whereas trends can be factored into more traditional market assessments.

2. Determine coming behaviors

Use the lessons of the 90s, as well as tools such as Jobs to be Done and the Drivers of Market Adoption, to assess how people and businesses are going to be buying and consuming differently. You need to build your strategy for the boom to come, not the world of yesteryear.

3. Develop alternative futures

Just as many firms moving at high velocity in the 90s sped quickly into trouble, you too may risk over-investment in one massive assumption. Think carefully about scenarios that involve intersections of trends and disruptions. Avoid hackneyed approaches such as Worst / Best / Middle-case scenarios (people always plan for the middle one) but rather develop truly distinctive, alternative futures and figure out what options you can develop to profit from each one.

4. Create your portfolio plan

With the prior steps taken, now is the time to build the portfolio plan that will guide your boom strategy. You will know what options are most important to cultivate, what dangers are most critical to hedge against, how much to concentrate your wagers, whether you are investing more for the short or long term, and how much risk you are willing to take in which types of endeavors.

Closing thoughts

Booms can be fantastically profitable times, but they also hold traps which ensnare the unprepared. Plan ahead. By learning from the past, rigorously charting the future, and developing a well-articulated strategy for rapid-fire industry change, you can help ensure that the coming heady years will avoid undue risk while generating large rewards. To learn more about how we can help you navigate the future, visit our webpage on our FutureCasting services.

HEADQUARTERS | 50 FRANKLIN STREET | SECOND FLOOR | BOSTON, MA 02110 | UNITED STATES | TEL. +1 617 936 4035

New Markets Advisors © 2023 - Terms of Use - Privacy Policy