|

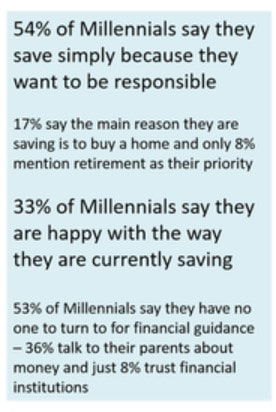

Millennials are no longer turning to their banks for advice. In fact, over 70% of Millennials would rather go see their dentist than listen to what banks have to say. Since the financial meltdown of 2008 the perception of banks has been significantly marred. Trust has been eroded and loyalty ruined. Adding fuel to the fire, today’s digital revolution is poised to impact the financial services industry in a way that hasn’t been seen since the ATM was introduced in the 1970s. Technological progress is affecting every sector of the industry including asset management in the shape of robo-advisors. These robo-advisors are growing at unprecedented rates by meeting Millennials’ jobs to be done — an important segment to attract as Millennials are now the largest generation in the US and are about to command the largest share of wallet in the US with an estimated $7 trillion in liquid assets by 2020. Disruptive innovations — a term coined by Harvard Business School professor Clayton Christensen — make what is previously costly, complex, or hard to access far more available to consumers. While the term “disruptive innovation” is often misapplied and over-used, this new breed of advisors is a disruptive innovation in the most accurate sense. Traditional brokerage accounts are riddled with obscure fees and conflicts of interest. Investment advisors typically charge anywhere from 1% to 3% of the value of your portfolio, severely affecting your overall returns. As John Oliver recently pointed out on his show Last Week Tonight while covering retirement plans, these fees are like termites — they are “tiny, barely noticeable, and can eat away your future”. In addition, banks will often recommend that their clients invest in funds run by their asset-management subsidiaries, creating a potential conflict of interest and undermining their clients’ trust. Access to information and advice also comes at a steep price. Many traditional advisors have hefty account minimum balance requirements that can reach $200,000 before they’ll even consider working with you. On top of all this, actively managed funds don’t necessarily do better than passive index funds! When Jon Stein founded Betterment — which launched in 2008 as one of the first robo-advisors to enter the market — he leveraged technology to create much broader access and offer investment management services to consumers at a fraction of the price. Gone were the minimum investment requirements as well as the obscure fees. Since the platform was using algorithms to help allocate investments, the company did not need a large advisory workforce to manage many accounts. This helped drive down operating costs and allowed Betterment to offer advisory fees as low as 0.15%. Numerous robo-advisors have launched since with over 200 firms in the market including companies such as Wealthfront, Personal Capital, and Nutmeg. These robo-advisors all operate on similar models — when consumers sign up, they are asked a few questions about who they are, such as their age and income, to determine their overall risk tolerance. The algorithms will then recommend a mix of assets based on textbook techniques for building up a balanced portfolio — more equities for younger individuals versus more bonds for someone about to retire. Most will allocate the portfolio to around a dozen or so low-cost ETFs. Typical features include automatic portfolio rebalancing and tax-loss harvesting. These platforms are attracting customers that larger asset management firms simply cannot target. 60% of Wealthfront’s customers are under 35 with an average account size right under $100,000, customers that a Merrill Lynch or Morgan Stanley broker could simply not serve profitably. While these offerings may appear simplistic compared with the services offered by established asset managers, robo-adviosrs are attracting Millennials in droves. In a follow-up to his idea of Disruptive Innovation, Clayton Christensen put forward the idea of Jobs to be Done in his 2003 book The Innovator’s Solution: don’t sell products and services to customers, but rather try to help address their jobs to be done. This is something robo-advisors are executing relentlessly against. Millennials are cautious and responsible. Having come of age during the great recession, many entered the workforce in challenging economic times. This shaped Millennials’ two main financial priorities: paying down debt and saving for the future. Over 86% of Millennials say they are actually saving today, and robo-advisors make it incredibly easy for new users to sign up and start saving. Many platforms enable users to start saving with little more than an e-mail address. Companies such as Acorns are making saving automatic for their customers. When clients link their debit or credit card to the platform, it will automatically round up the transactions and invest those into a portfolio based on each individual’s risk profile. In addition to making the saving process seamless, many of the platforms have put a strong focus on their user experience to meet Millennials where they already are — their smartphones. Over 77% of Millennials say their mobile phone is always with them, and 49% prefer mobile banking to any other banking channel. While many traditional brokerage accounts tout having intuitive mobile applications, the reality is that these are often ill-adapted web transplants. Newer platforms built their applications for mobile first allowing them to embody Millennials’ expectations of having access to information anywhere and at any time. The experience has been simplified to provide always up to date information quickly and visually. This makes it easy for Millennials to track their money, make new deposits on the go, and receive timely updates and advice. Robo-advisors are not only meeting Millennials’ functional jobs to be done, they are also meeting their emotional jobs to be done. In contrast to previous generations, Millennials are not saving for specific objectives such as a house, or for retirement. Instead they are saving based on profound emotional jobs — they are saving to feel responsible. 54% of Millennials say the primary reason they are saving is because they want to be responsible, while only 17% say the main reason they are saving is to buy a home, and only 8% mention retirement. Yet, while diligent and responsible, Millennials stand at a crossroads. Most Millennials feel there is more they should be doing with their money, yet many just do not know what to do. Robo-advisors help Millennials feel confident that their money is doing more than what they could be doing alone. By providing tailored information and advice based on their individual preferences, robo-advisors make Millennials feel informed and knowledgeable. Setting transparent, low-cost fees also helps instill a sense of trust — something that has been lost with larger established organizations. Finally, many robo-advisors enable Millennials to save and invest in companies that reflect their personal values. Earthfolio, for example, is a firm that provides automated investing services focused on funds that promote social and environmental progress. While traditional brokerages can feel overly complex, robo-advisors meet many Millennials’ emotional jobs by making them feel more knowledgeable, purposeful, and responsible. As of today, even the largest robo-advisors only represent a drop in the bucket compared to the established asset managers. BlackRock alone has $4.6 trillion in assets under management (AUM) while the entire robo-advisors industry is just reaching $21 billion AUM. Yet attracting Millennials early creates tremendous potential for future success. Robo-advisors are a disruptive innovation that satisfy key functional and emotional jobs and incumbents are taking note. JPMorgan Chase and Goldman Sachs have backed Motif, UBS has partnered with SigFig, Charles Schwab has launched their own automatic advisor Schwab Intelligent Portfolios, and Vanguard just launched their own hybrid automated tool Vanguard Personal Advisor Services. Retaining Millennials loyalty may be more challenging than expected though. As Millennials enter new stages of their lives, such as starting families and establishing homes, robo-advisors have the opportunity to help them develop more comprehensive financial plans and establish true partnerships. Their success will depend on whether they can retain Millennials and secure their loyalty by satisfying their next set of jobs to be done.

Story by Sebastien Latapie. Comments are closed.

|

7/11/2016