|

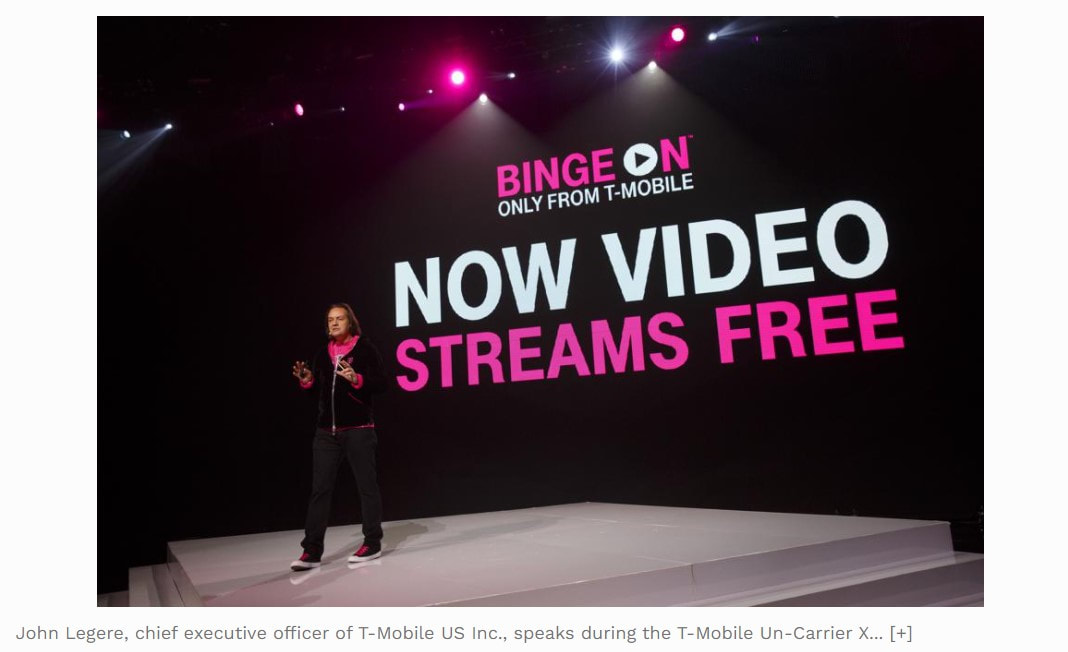

This post was co-written with my colleague David Farber. T-Mobile has been working hard to shake its image as a fringe player among mobile carriers. As Verizon and AT&T comfortably enjoyed the top two spots in the industry, T-Mobile spent a number of years proving its worth against other upstarts and smaller players. But now T-Mobile has made it clear that it’s not content with a fourth- or even third-place finish. Earlier this year, T-Mobile showed that it was able to gain market share faster than anyone else in the industry, and it even boasted a slightly higher customer retention rate than either of the market leaders. This week, the fight continued with the announcement of T-Mobile Binge On, a free upgrade for users of its Simple Choice plan. Starting November 15, subscribers to qualifying plans will be able to stream unlimited video from providers like Netflix, Hulu, and HBO without it counting against their data usage. While Binge On will likely attract a lot of attention, it’s just one piece of what we see as a three-part strategy for taking on the market leaders.

Refreshing perceptions of coverage. Historically, T-Mobile struggled with the perception that it was cheaper, but you were getting what you paid for. With fairly large gaps in coverage, dropped calls were a significant concern for potential new customers. Recently, however, T-Mobile has focused not just on improving its coverage, but on making the breadth of its network a selling point. In the last year, the company has doubled its 4G LTE coverage and introduced Wi-Fi Calling, which allows customers to call and text anywhere they have a Wi-Fi connection. T-Mobile has also introduced its Lifetime Coverage Guarantee, offering to refund both device and service costs (subject to certain limitations) for customers who are dissatisfied with the network’s coverage. Targeting valuable customer types. Having coverage that’s just as good as the industry leaders isn’t a compelling strategy on its own. Why buy something that’s good enough if you’re already used to getting the best? That’s where T-Mobile Binge On comes in. T-Mobile already offered a good reason to switch for heavy travelers, including the lucrative business traveler demographic. As part of its Simple Choice plan, subscribers have free access to unlimited data and texting in over 140 countries. Ultimately, though, that’s a relatively small segment of the population. With Binge On, T-Mobile has positioned itself to appeal to broader swathes of the population. In particular, Binge On should appeal to cord cutters – those who have abandoned traditional cable contracts in favor of watching TV via the Internet. Cord cutters tend to be younger, urban adults who are setting up roots, establishing their buying patterns, and steadily increasing their earnings. If T-Mobile can turn cord cutters into loyal customers now, it can gain access to a valuable customer subset for years to come. Reducing switching costs. While the first two steps focused on giving customers a reason to try T-Mobile, the third step is focused on making it easy to do so. And the groundwork for that is already in place. T-Mobile has made its name by being cheaper than the market leaders, but real monthly costs aren’t the only consideration for customers. That’s why T-Mobile will pay off the balance on old device payment plans, buy out your existing contracts by paying your early termination fees, and guarantee locked-in rates for as long as you remain a T-Mobile customer (without signing a long-term contract). Inertia can be a powerful force to compete against, but T-Mobile is at least taking significant steps to reduce the obstacles for customers thinking about making a switch. T-Mobile is clearly swinging for the fences with its new strategy. Its international data and text access, contract buy-outs, and free video streaming offerings can all be cost-heavy programs at scale. With that said, the company has already taken steps to reduce those costs. For example, it resells smartphones when it buys out device payment plans and gets additional revenue from customers who then buy new devices. It has also reduced the costs it incurs related to streaming video, and it further saves money when customers use Wi-Fi Calling, which pushes service off T-Mobile’s network. And if this strategy has a big impact on market share, those approaches may pay off handsomely. Rumors were already swirling that Comcast would try to buy T-Mobile after its failed attempt at a Time Warner Merger. As Comcast looks to replace lost revenue as cord cutters increase in number, T-Mobile’s strategy could make it an attractive acquisition target. Number 3 competitors in a market need to play the game differently than their rivals. T-Mobile has shown repeatedly how a company with limited traditional assets can open totally new fronts in this complicated war. Click here to receive an article on setting strategy for new or uncertain markets. Comments are closed.

|

11/17/2011