|

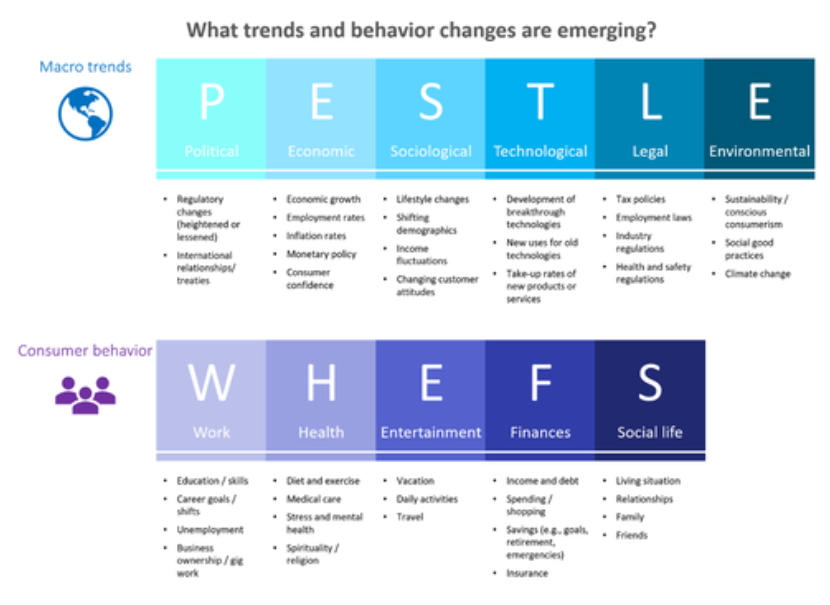

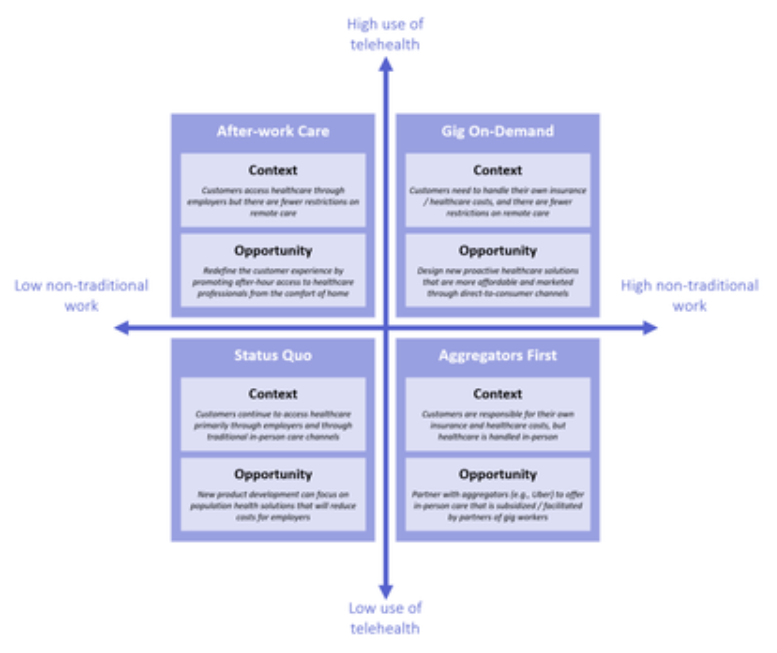

By Dave Farber I talk with clients these days, I often hear them ask a recurring question: how do we know which customer behavior changes will endure and which behaviors will revert to normal in the coming months? While there are tools out there for trying to predict the changes that will persist, in many cases we simply don’t know the answer. And that’s not necessarily a problem. When built correctly, innovation programs are inherently designed to generate successful solutions for markets and contexts that we don’t always know that well. We simply need to dust off the tools we already have and think about how they can help us answer a new set of questions. Trend spotting: Identify the behaviors that are changing. Insights teams are already used to looking at macro trends to see what major shifts are occurring and the impacts those are having on consumer behavior. They’re looking at the effect of things like mass weather events, urbanization, and population aging to see how that affects more nuanced behaviors such as travel plans, home buying, and healthcare spending. COVID-19 (the novel coronavirus) isn’t necessarily a trend in its own right, but it will have an impact on the trends we were already watching. That makes now the right time to consider which trends will see the biggest shifts and what those shifts will mean for consumer behaviors. Beyond looking at broad trends, it’s helpful to understand how trends translate down to the human level. This is a step that teams often overlook. While frameworks like PESTLE are often used to broaden our thinking and spot trends across a wider range of domains, we often forget to narrow that lens again later to refocus on human behaviors. We talk in terms of trends, and we talk about our company’s offerings, but we miss that middle step that focuses on real people. Think about the essential parts of a consumer’s life — their health, finances, employment, and so on. Consider how those trends you’ve found are causing shifts in those day-to-day areas. Scenario planning: Outline the possibilities for how customers will behave. Once you have identified the consumer behaviors that are changing, you may find yourself with a pretty long list. The next step is prioritization. Rather than trying to guess how each change will play out, assess which trends are likely to have the highest impact and which ones present the greatest uncertainty. Then create a grid to envision the different ways in which the future may unfold. While scenario planning is often covered in an MBA class and soon after forgotten, it’s a key tool for navigating uncertainty. Say, for example, that your focus is health insurance. Using the PESTLE framework, perhaps you’ve noticed that regulations around telehealth have been loosening (a political change) and that unemployment is on the rise (an economic change). Translating this down to the consumer level, you’re seeing higher consumer interest in remote doctor visits and a higher volume of consumers experimenting with gig work to pay the bills.

It’s not clear how many consumers will revert to traditional work compared to the number who enjoy the freedom that gig work offers. But it will have a big impact. Gig work typically doesn’t come with health insurance, which means that consumers may have to buy insurance on their own (assuming they don’t forgo it entirely). Non-employer-sponsored plans tend to create higher out-of-pocket costs. In that scenario, it may be beneficial to focus on affordable healthcare solutions marketed directly to the consumer. If, on the other hand, both trends reverse and people are visiting doctors in person and accessing insurance via their employers, it may make more sense to focus on population health solutions (such as on-site screenings) that can lower employer premiums. Different scenarios will better fit some solutions than others. Portfolio planning and organizational agility: Plan for the unknown. Without knowing which scenario will occur, innovation seems tricky. How do you choose between the affordable direct-to-consumer (DTC) products and the population health management path? There are two options, which are often used in combination. The first is to ensure your innovation roadmap adheres to a portfolio plan. You may opt to make multiple smaller bets that help you build a foothold in the high-potential scenarios that could come to pass. Knowing that it’s not an all-or-nothing proposition, you might start testing the waters of DTC offerings in the hopes that this will become a growth area while recognizing that efforts around population health might still be helpful for the core business, which isn’t going away any time soon. The second option focuses on larger initiatives. With higher levels of investment, you may not be able to make multiple bets across scenarios. In that case, you need to think about how your innovation project can quickly shift directions. How would the solution need to change if the scenario you’re expecting isn’t the one to materialize? What does that mean for its design, your internal staffing and resources, and your go-to-market plan? Carefully plan for changes in advance, so if the time does come that you need to pivot, you can do it quickly with as little disruption as possible. It’s hard to say exactly how the future will unfold. Consumers are bad at predicting their own future behavior, and we’re currently facing a lot of unknowns. That doesn’t mean that innovation should wait until all uncertainties are resolved. Innovation is necessarily about taking bold strides into the fog, developing the solutions we all want before we even know we want them. By relying on the tried-and-true innovator’s toolkit, we can take those bold steps without exposing our organizations to unnecessary risk. Dave Farber is a strategy and innovation consultant at New Markets Advisors. He helps companies understand customer needs, build innovation capabilities, and develop plans for growth. He is a co-author of the award-winning book Jobs to be Done: A Roadmap for Customer-Centered Innovation. Comments are closed.

|

4/22/2020