|

WORKING PAPER

What Behavior Changes Will Last

|

|

When do behavior changes last?

COVID-19 has forced us to live and work differently. At the onset of the pandemic, our children were taking virtual piano lessons, while in the next room we ran 4-hour workshops with clients. Over a year and a half later, many of us are still working from home and juggling far more considerations than pre-COVID when making travel plans or organizing family gatherings. Health concerns and financial pressures, not just social distancing, are driving fundamental changes in our priorities. Some of the new ways that we shop, sell, and respond to people are cumbersome, but others, perhaps surprisingly, seem for the better.

The key question is: what new behaviors will stick once the crisis passes?

Fortunately, the tools for assessing new markets apply to understanding which habits will persist. After all, one way to determine the viability of a new market is to evaluate whether traditional behaviors will change. In this paper, we show how to apply these methods to your industry, which you can use to assess whether and how your sales, service, customer experience, and operations will revert to old patterns or be permanently altered.

Our research on how new markets develop shows that six factors lead to lasting behavior change. Not all six need to apply to every new market, but the factors reinforce each other – the more are involved, the stronger the impact.

The key question is: what new behaviors will stick once the crisis passes?

Fortunately, the tools for assessing new markets apply to understanding which habits will persist. After all, one way to determine the viability of a new market is to evaluate whether traditional behaviors will change. In this paper, we show how to apply these methods to your industry, which you can use to assess whether and how your sales, service, customer experience, and operations will revert to old patterns or be permanently altered.

Our research on how new markets develop shows that six factors lead to lasting behavior change. Not all six need to apply to every new market, but the factors reinforce each other – the more are involved, the stronger the impact.

1. Core Motivations Shift

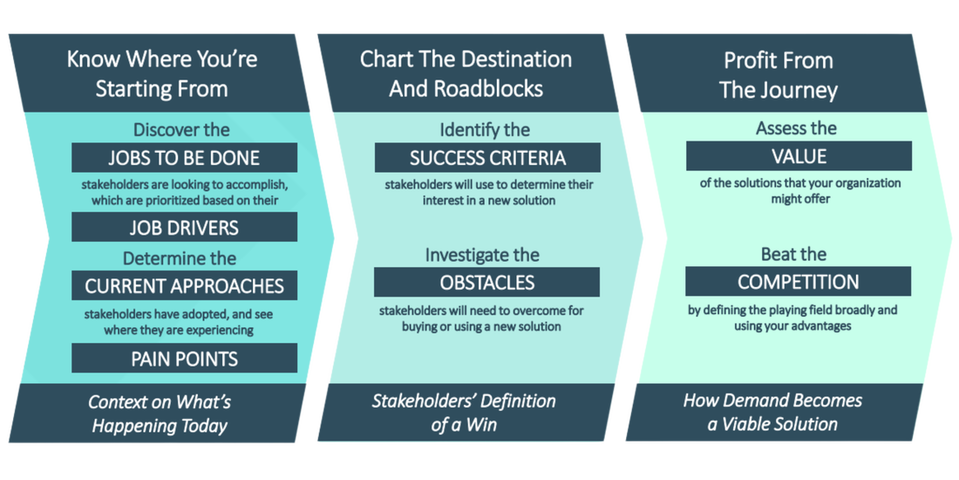

In our book Jobs to be Done, we describe a tool called the Jobs Atlas (summarized in the graphic below) which helps companies understand the landscape of their customer’s priorities. The beating heart is the customer “Jobs to be Done,” which are the underlying functional and emotional motivations that cause B2C or B2B customers to act the way they do.

With the coronavirus, we need to assess whether the importance of key Jobs has shifted in an enduring way. If so, that can become the foundation for distinctive new habits. The safety of elderly parents, for instance, became more of a priority for many of us in the wake of the pandemic. Even as governments launched their vaccination campaigns in early 2021, the roll-out was slow and left plenty of time for us to worry about the elderly’s immunity to variants and the uptick in social activity. Is that because nonstop news coverage forced us to think about it constantly, and our behavior will revert once the newsworthiness passes? Perhaps not, if painful events get seared into our memories, provoking behavior changes such as frequent check-ins and more thoroughly vetting safety protocols before selecting a nursing home.

Unlike the latest runway fashions, customer Jobs to be Done typically do not change year to year. That makes events like the coronavirus – an event so disruptive that it has the power to cause fundamental shifts in core motivations – an eye-opening opportunity for deep-rooted behavior change.

The Jobs Atlas

In our book Jobs to be Done, we describe a tool called the Jobs Atlas (summarized in the graphic below) which helps companies understand the landscape of their customer’s priorities. The beating heart is the customer “Jobs to be Done,” which are the underlying functional and emotional motivations that cause B2C or B2B customers to act the way they do.

With the coronavirus, we need to assess whether the importance of key Jobs has shifted in an enduring way. If so, that can become the foundation for distinctive new habits. The safety of elderly parents, for instance, became more of a priority for many of us in the wake of the pandemic. Even as governments launched their vaccination campaigns in early 2021, the roll-out was slow and left plenty of time for us to worry about the elderly’s immunity to variants and the uptick in social activity. Is that because nonstop news coverage forced us to think about it constantly, and our behavior will revert once the newsworthiness passes? Perhaps not, if painful events get seared into our memories, provoking behavior changes such as frequent check-ins and more thoroughly vetting safety protocols before selecting a nursing home.

Unlike the latest runway fashions, customer Jobs to be Done typically do not change year to year. That makes events like the coronavirus – an event so disruptive that it has the power to cause fundamental shifts in core motivations – an eye-opening opportunity for deep-rooted behavior change.

The Jobs Atlas

2. New Approaches Are Appealing

New behaviors can sometimes surpass the attraction of longstanding old habits, but without a trigger like the coronavirus, people don’t experiment. For example, when the London Underground was shut down for 2 days during a 2014 strike, commuters were forced to find other options to get to work. Even though the trains were only out of service for 48 hours, thousands of Londoners (about 5%) never returned to the Tube, having found alternatives that were cheaper, faster, or more comfortable. Do the new customer behaviors we have witnessed over the last year and a half exceed old behaviors on certain key dimensions, such as cost, speed, or hassle?

In the Jobs Atlas, we call these dimensions Success Criteria, and we use them to measure how well Current Approaches are accomplishing key Jobs to be Done. Success Criteria that are poorly addressed can easily spark new behaviors. For example, in competitive real estate markets such as New York City and Boston, home shoppers have long been frustrated with their options for viewing a property: they either have to jam an obscure two-hour open house window in their schedules, or juggle the calendars of busy realtors and sometimes begrudging current tenants. If on-demand video tours make it more convenient for buyers to view homes – and enable them to view a higher number of options for quick comparison – consumers might prefer this option even after we settle into the new normal.

New behaviors can sometimes surpass the attraction of longstanding old habits, but without a trigger like the coronavirus, people don’t experiment. For example, when the London Underground was shut down for 2 days during a 2014 strike, commuters were forced to find other options to get to work. Even though the trains were only out of service for 48 hours, thousands of Londoners (about 5%) never returned to the Tube, having found alternatives that were cheaper, faster, or more comfortable. Do the new customer behaviors we have witnessed over the last year and a half exceed old behaviors on certain key dimensions, such as cost, speed, or hassle?

In the Jobs Atlas, we call these dimensions Success Criteria, and we use them to measure how well Current Approaches are accomplishing key Jobs to be Done. Success Criteria that are poorly addressed can easily spark new behaviors. For example, in competitive real estate markets such as New York City and Boston, home shoppers have long been frustrated with their options for viewing a property: they either have to jam an obscure two-hour open house window in their schedules, or juggle the calendars of busy realtors and sometimes begrudging current tenants. If on-demand video tours make it more convenient for buyers to view homes – and enable them to view a higher number of options for quick comparison – consumers might prefer this option even after we settle into the new normal.

|

KNOW YOUR JOBS TO BE DONE: BUSINESS TRAVEL IN A POST-PANDEMIC FUTURE In the midst of an event as momentous as a pandemic, it is tempting to attribute every lasting change to COVID-19. This is especially true when the crisis is likely to pass without a clearly defined ending – a slow drag to the finish line rather than a sudden, sweeping victory. But COVID-19 wasn’t the only event we witnessed in the last year and a half. Elections happened, armed conflicts flared up, and global warming carried on, among many others. While each of these phenomena may not have altered our daily life for many of us as dramatically as COVID-19 did, they can influence overarching trends in consumer behavior. |

Take business travel. COVID-19 showed us just how easy it is to conduct meetings remotely rather than in person. While we may suffer from Zoom fatigue, companies are saving a lot of time and money organizing these calls at a distance. However, it would be wrong to say that COVID-19 is the only deciding factor in the future of business travel. Other concerns may come into play, such as climate change. With the proliferation of forest fires and heat waves, we are far more attuned to the reality of global warming, which in turn could impact our willingness to travel by air (especially among younger generations). To compete successfully, the business travel industry must be clear about customers’ Jobs to be Done and corresponding Success Criteria.

3. Inertia Ends…

Inertia – doing things the same way simply because that is the way things have been done – can be one of the biggest impediments to new behavior (we call these Obstacles in the Jobs Atlas). Inertia can impede the spread of even the most stellar ideas. Consider this: indoor plumbing took 4,500 years to catch on, partly because it required redesigning homes and cities from the ground up. Carrying buckets of water felt easier in the short term.

…Only For It To Resume Afterwards Using a more contemporary example, ordering pet food online makes a great deal of sense for consumers who are in certain circumstances, such as living far from a pet store, being unable to lift heavy bags, or Requiring special diets. But a sizable percentage report that they haven’t done it because they just haven’t ever thought about it. For situations like that, confinement due to the coronavirus has been the greatest inertia-breaker. Habits have changed, and they may never go back to “normal.”

4. …Only For It To Resume Afterwards

While the coronavirus has been the force to alter some behaviors, changing back may not be easy. Some hospitals, for example, are restricting visits by sales representatives of life science companies because these people might bring disease. Will they be allowed to resume their sales calls? Doing so will require several decision-makers to assent, the hospital may want to survey physicians to see if they prefer the new ways of working, and work habits may need to change for a second time to interact with these sales representatives when they return. Moreover, the life science companies may have embraced virtual sales during this timeframe, and they may seize the opportunity to cut back on expensive in-person visits. These factors may point the way to behavior change that is going to endure.

5. Critical Mass Is Achieved

Change also sticks if there is a critical mass of colleagues who have made the shift, creating network effects. This may be the case with Netflix’s new Party feature, which allows subscribers to watch movies simultaneously with friends and to comment to each other electronically in real-time. Netflix Party gained its first half million users in just one week – a critical mass that can catapult it to becoming a natural place to share entertainment with friends and family in the future.

Equally, critical mass helps people avoid negative impacts from instigating change, such as the potential guilt with being the only remote person on a Zoom call. When everyone is doing it, it’s easier to stick with the behavior.

6. Infrastructure Locks In Change

Another driver of stickiness is infrastructure. Many of us did not have good equipment for home offices before this crisis, but now that we have invested in a superior set-up, we may prefer to work at home more often. Similarly, if we’ve paid for home fitness equipment, it is less appealing to renew our old gym memberships. The upfront costs of these investments long impeded change in behavior, but once we’ve spent the money it’s much more tempting to continue on the new course.

|

AT-HOME PET GROOMING Infrastructure isn’t all about financial costs and equipment – it can also involve building new skills. During long periods of COVID-19 confinement, many pet owners were forced to learn how to groom their pets. Sales of grooming products peaked in May 2020, and remain substantially above pre-COVID levels to this day. While their initial forays into at-home grooming may have been difficult, many owners are now skilled and comfortable with this new routine. As we make our way back to the office, pet owners may decide to continue at-home grooming as a way to stay connected with their pet. |

How research can tell which changes will stick

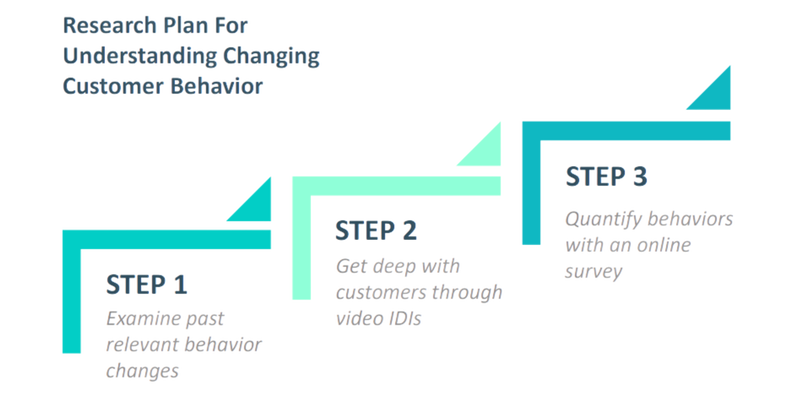

Step 1 : Examine Learnings From Past Behavior Changes

If your industry has undergone radical shifts in behavior due to previous events, learn what you can from the past. How was your industry changed by the 2008 financial crisis, or a major natural disaster, or a groundswell of pressure from consumers or policymakers? What forces drove that change? How much reversion was there to old norms once the moment passed, and what types of customers changed back first?

Step 2: Get Deep With Customers

Understanding the workings of a behavior change requires careful probing of customers, in a way that adapts to their particular context and doesn’t lead the witness. Particularly when trying to project future habits, it’s critical to avoid over-simplification and excessive rationalization. To accomplish this, in-depth interviews, executed via webcam, are typically the best methodology. They allow you to find out the story behind the behavior changes the customers have undertaken, along with how those shifts interacted with other deviations from normal habits. You can use the Jobs Atlas to get a full view of how priorities may have changed, how new approaches stacked up, and what types of inertia were in play. Once you have this view of a customer’s landscape, you can then explore specific drivers of change and determine whether that change will stick, or even change further still.

Don’t show your hand to your interviewees too early. You want to understand the world through the customer’s eyes, without biasing them by inserting what’s important to you. Their priority usually isn’t the particular behavior change you’re most interested in; rather, that behavior is accomplishing or impeding certain Jobs, so you need to get a view of those factors in order to get a realistic picture of how likely things are to shift. At the end of the interview, you can ask your most pressing questions flat-out, but without first getting a nuanced understanding of the customer’s context you risk asking the wrong questions in the wrong way.

Step 3: Quantify

Last, spread your net to examine a broader number of customers, and obtain hard data on their habits, priorities, and likelihood of change. An online survey can do this well. It’s best, if possible, to precede the construction of the survey with the work done in Steps 1 and 2, so that you can be certain you zero in on the most important factors, and that you do so in the language that customers actually use.

The survey shouldn’t ask about behaviors in general, as people don’t make actual decisions that way. Rather, they typically put decisions in their context. For instance, they don’t determine how much they’ll be eating at restaurants overall. Instead, if it’s a Saturday evening with the children, they consider how much they are trying to make it special, as opposed to accomplishing other Jobs, and how going to a restaurant stacks up against other realistic alternatives. Survey questions can determine the prevalence of the Job, as well as the Drivers (attitudes, long-term context, and short-term circumstances) that make it most relevant. In doing so, the survey enables a reality check on projections of behavior change, since the behaviors have to map to critical Jobs if they are actually going to persist.

To capture the drivers of change, the survey can ask how the customer’s decision once the pandemic passes might be different than the period before coronavirus. If there is indeed a distinction, the survey can then probe on the specific reasons why views have shifted, and how firmly they’ve changed. Oftentimes, customers won’t be able to accurately predict their behavior in the future, but it’s more feasible to ask about how their Jobs, Drivers, Success Criteria, and Obstacles will vary from the present. This data can also help determine the scale of change that will occur, and for which segments of the customer population.

Behavior shifts are often a social phenomenon, whether the customer in question is an individual or an enterprise. People tend to change in groups. Surveys are key tools for assessing whether a critical mass of customers will persist with the new normal or go back to their old ways.

Closing Thoughts

We don’t need a crystal ball to forecast behavior change. The approaches used to assess these factors for new markets apply to unusual situations like the COVID-19 pandemic. We may struggle to articulate how our behavior might shift, but by parsing out drivers of change, obstacles to it, and the distinct elements of motivation and context, we can create a far clearer view of what the future brings.

Shape Divider - Style tilt_opacity

HEADQUARTERS | 50 FRANKLIN STREET | SECOND FLOOR | BOSTON, MA 02110 | UNITED STATES | TEL. +1 617 936 4035

New Markets Advisors © 2023 - Terms of Use - Privacy Policy