|

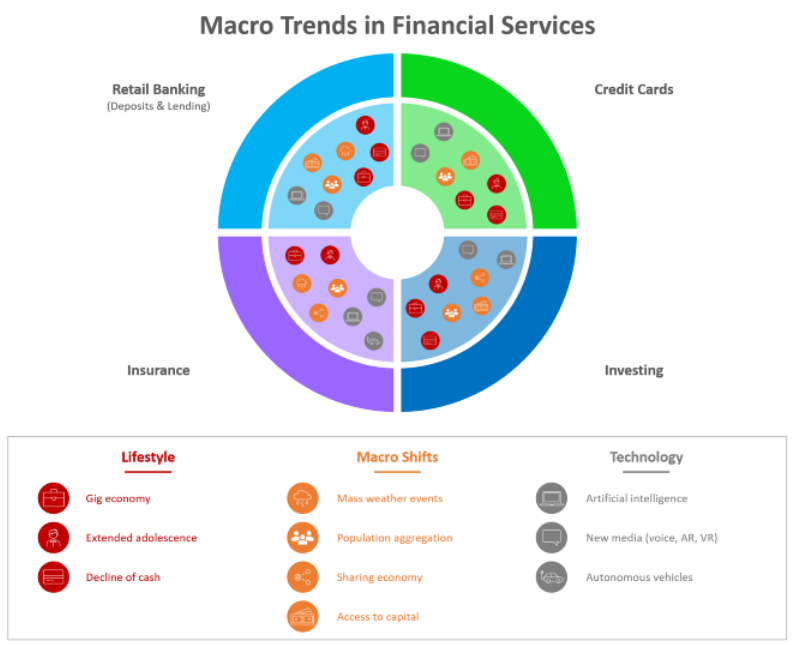

By Dave Farber Innovation is all about delivering value to organizations by finding new ways to help consumers achieve the jobs they are trying to get done. One of the nice things about taking a Jobs to be Done view of innovation is that jobs tend to be stable over time. The jobs that consumers are trying to get done today are the same jobs that consumers will be trying to get done five years from now. Despite the stability in what consumers are trying to achieve, plenty of things do change. Competitors may be putting out new offerings that are helping consumers accomplish their goals. So while consumers may still care about building their retirement nest egg, for example, the range of low-cost funds and robo-advisors that have come onto the market have helped consumers make progress toward getting that job done. The more progress consumers make toward one job, the lower that job ranks in terms of opportunity for organizations. It becomes time to focus on other jobs where consumers have more of a struggle to get that job done. Another force of change is the emergence of a new macro trend. As societies evolve and new technologies materialize, certain jobs may rise in importance or organizations may have new levers to pull to help consumers make additional progress. Based on my work in financial services, I’ve identified ten trends that will have a major impact on consumers in the coming years, and I’ve mapped those trends based on their impact to different sectors of the financial services industry. Innovation teams should be thinking about how work related to these trends can fit into their broader innovation portfolio. Lifestyle trends Gig economy — One of the most important trends I’ve been following over the past few years is the rise of the gig economy. When you consider the full gamut of gig workers — from the freelancers who use their gig to make a living to the full-time employees using their gig to make a little extra on the side — the numbers are massive. Even by conservative estimates, the number of U.S. gig workers has grown by over 15% in the past decade, bringing the total number of gig workers to over 50 million. That’s more than one third of the U.S. workforce. This big shift in employment has created challenges for workers, but those challenges create corresponding opportunities for financial services companies that are willing to innovate. Many gig economy workers lack access to benefits that traditional workers take for granted. They miss having paid time off, and they find themselves over-paying for under-performing insurance policies, assuming they have insurance at all. Nearly 50% of gig economy workers are not saving for retirement, and almost 30% are not building any savings for emergencies. Many of these workers also note that their income is inconsistent, meaning that they frequently need access to short-term lending solutions. There is no shortage of needs that financial services companies can help address. Extended adolescence — The confluence of economic downturns, rising education costs / student loan debt loads, and rising real estate prices has fostered the emergence of a new life stage: extended adolescence. Many younger Americans may be relying more heavily on their parents for financial support for longer periods of time. While this group faces fewer financial responsibilities in some respects (e.g., not paying a mortgage), they are actively seeking near-term help (e.g., saving for a down payment, paying off debt) and will likely need accelerated retirement savings solutions as they defer thinking about long-term savings while those immediate needs are addressed. Moreover, this expanded dynamic of parents and children co-managing finances creates opportunities to improve the customer experience across many financial products. Decline of cash — The use of cash has continued to decline for the past several years, and debit cards are now the most commonly used payment instrument in the U.S. (28% of payments). Even where cash persists, it is heavily relegated to younger individuals (under 25) and small purchases (under $10). Cash use is particularly low for those aged 25–44; those individuals use their debit cards most frequently (34% of payments). As alternative forms of payment continue to grow — P2P payments, mobile payments, cryptocurrencies — financial services companies may need to think about what impact these changing spending dynamics will have on their revenue models. At the same time, there’s a growing opportunity to think about how organizations can better serve customers to attain greater presence in consumer’s wallets and their lives. Macro shifts Mass weather — As extreme weather events become more frequent, so too do the impacts: damaging winds, floods, and fires. Insurance companies will need to account for these growing risks and a fundamental change in the math behind how they operate. Because mass weather events also cause businesses to close and lead to other longer-term effects, other financial services companies should also be paying attention. Consumers and small businesses will increasingly be looking for new lending products as they deal with periods of unemployment or seek to rebuild. Aggregation — People are using platforms at unprecedented rates. Whether it’s drivers making themselves available on Uber or individuals watching movies on Netflix rather than in individual theaters, people are virtually congregating in a way that shouldn’t be ignored. Among other benefits, platforms make it easier to find substantial foothold markets and leverage the trust that has been built by a non-competitive brand. Sharing economy — Houses, office space, cars, skills, used goods — assets of all kinds are currently being shared. These new use cases for property create easy opportunities for insurance companies to design products for property owners, users, and the platforms that facilitate sharing. Less obviously, the inclination toward sharing creates opportunities to help people invest in assets that they can then share to create secondary income streams. Access to capital — Credit card companies and traditional lenders have been steadily developing more sophisticated ways of assessing risk, which allows them to provide greater access to capital to groups that previously only had access to predatory lending products. At the same time, microlending and P2P lending have become more widespread, further broadening access to capital. At the same time, there’s more room to grow in that space, particularly when it comes to providing loans and credit to traditionally under-served populations. Additionally, as consumers find ways to smooth their income and overcome day-to-day financial issues, they’ll be well served by companies that can help them better save and invest their leftover funds. Technology

Artificial intelligence — Many of the use cases for AI within financial services are obvious — credit decisions, risk management, cost savings, improved investment advice. Many of the first-movers in this space have relied on an M&A strategy to acquire AI capabilities that can generate quick returns. The real winners, however, will be those who think holistically about the opportunities for business model innovation and develop a well-considered strategy that integrates AI in multiple ways. There is still plenty of progress to be made around cybersecurity, personalization, and profit models that have yet to be unearthed. New media — Voice assistants, augmented reality, and virtual reality are generating a lot of buzz, but few financial services companies have made real progress turning those technologies into customer value. An improved customer experience and alternative contact center approaches are just the beginning. Much like with AI, companies need to look beyond what’s trendy to determine where real value can be introduced. Autonomous vehicles — Self-driving cars are going through more and more rounds of testing and pilot programs, and it will certainly be a while before they are widespread. But even in the near-term, insurance companies need to think about how traditional views of risk and liability are changing. And to the extent that autonomous vehicles extend beyond consumer use (e.g., mass transit support), the opportunities for innovation grow too. Dave Farber is a strategy and innovation consultant at New Markets Advisors. He helps companies understand customer needs, build innovation capabilities, and develop plans for growth. He is a co-author of the award-winning book Jobs to be Done: A Roadmap for Customer-Centered Innovation. Comments are closed.

|

8/20/2020