|

By Steve Wunker This blog first appeared as Steve Wunker’s piece for Forbes As the coronavirus creates a Great Reboot of the economy, one sector that’s already winning is telehealth. As Christopher McFadden, a Managing Director specializing in healthcare investing at the leading private equity firm Kohlberg Kravis Roberts (KKR) told me in an interview, “We saw 10 years of telehealth adoption in about 8 weeks.” In fact, McKinsey now estimates that telehealth will be a quarter trillion – that’s no typo – dollar opportunity, up from about $3 billion in U.S. revenues pre-coronavirus. So, what does this mean for the healthcare industry and investment opportunities? First, consider why this is happening. There are two major drivers of this phenomenal growth: Costovation and convenience. Costovation – innovation that radically cut costs – is a factor because we see new technologies, business models, and customer experience all working together to make telehealth happen; this isn’t simply a matter of transposing office visits to a screen. Rather, effective telehealth delivery involves big changes in how physicians diagnose, patients participate, technology authenticates, office staff add value, and services are billed. Telehealth can also enable healthcare providers to be in low-cost locations, not in expensive Manhattan high-rises, for example. This will become an even more significant factor if cross-state physician licensure requirements are relaxed. These innovations can lower health insurers’ costs both due to reimbursement to doctors being lower (due to their higher utilization and lower costs), as well as through ensuring that patients come to physicians’ offices or urgent care sites for only the right reasons. Moreover, making healthcare more accessible healthcare can ultimately reduce the cost of caring for chronic diseases that become more expensive to treat as they progress.

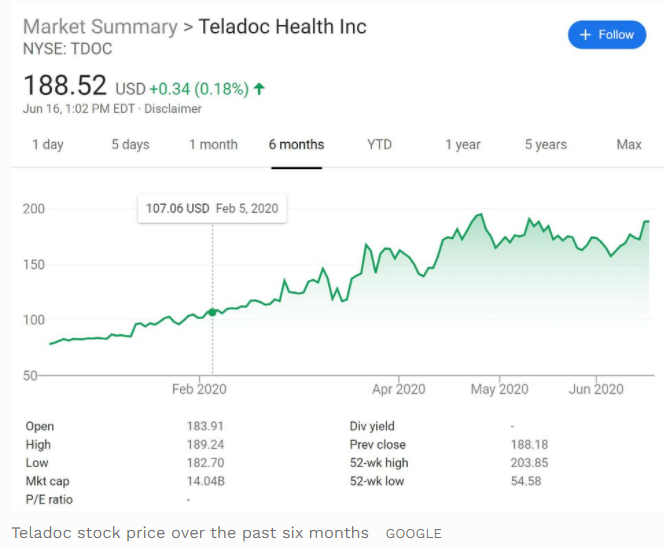

Clearly, telehealth is also convenient. As Seema Verma, administrator for the Centers for Medicare and Medicaid Services (CMS), recently stated, “I can’t imagine going back. People recognize the value of this, so it seems like it would not be a good thing to force our beneficiaries to go back to in-person visits.” CMS enabled the recent explosive growth of telehealth through changing both its reimbursement policies and other key requirements for telehealth visits, so Verma’s endorsement is a critical indicator of the industry’s bright future. We can consider the impact of this growth in three ways: 1. New models of care delivery KKR’s McFadden provided examples of novel care delivery in our discussion, referring to companies in the investment portfolio. “Consider One Call, a leader in coordinating medical services, including physical therapy (PT), for the workers’ compensation industry. When COVID-19 hit, One Call quickly converted thousands of in-clinic PT patient appointments to telerehab to reduce infection risk. From the comfort of their own home, injured workers are using a video link to virtually meet with a physical therapist who keeps them on the road to recovery by assessing and monitoring their care, just as they would in a brick-and-mortar clinic. Since February, One Call PT providers offering telerehab has increased more than 10x to 7,500.” In a totally different realm, McFadden cites psychiatry. “InnovaTel is a national telepsychiatry platform. There are thousands of community health centers in the U.S. providing behavioral care, however many regions of the country experience a severe lack of mental health professionals. InnovaTel had already been working with many of these centers by delivering virtual patient care in dedicated treatment rooms; a patient would come into the clinic and meet their psychiatrist on-screen. In response to COVID, the company pivoted to offer the option of treating patients in their home via a computer or phone. Today, in coordination with their clinic clients, over 75% of InnovaTel’s patients are receiving home-based psychiatric care.” This is just the tip of the iceberg. Some countries are experimenting with fully virtual means of treating disorders around endocrine function, for example, so that patients do not need to travel to see scarce specialists. 2. Implications for suppliers to the healthcare industry These new care delivery models can greatly impact suppliers to the industry. Prescribing patterns may change, for example, as patients can access specialists more easily. Patient appointments might be shorter, meaning that there will be a need for more support of patients in between visits to answer questions and counsel on issues such as lifestyle change and risk reduction; both life science companies and health insurers can play a key role in providing this. Sales will also change, as physician practices become harder to visit and are more bound up in tightly-administered healthcare organizations which provide doctors with less autonomy to choose among competing drugs and medical devices. 3. Implications for healthcare providers Health systems are generally not renowned for their fast-moving agility. But with the rapid arrival of telemedicine, speed will be essential. Companies that can facilitate this will be in winning positions. McFadden said of one example, “Early this year, Teledoc announced the acquisition of InTouch Health, which had built middleware to allow large hospital systems to deploy enterprise-scale telehealth. That transaction now looks very smart.” McFadden does not expect that all health systems will be able to navigate this change. “As elsewhere in the economy, the strong will get stronger. Already, almost 50% of U.S. doctors are employed by health systems or large provider networks, and we should expect that to accelerate. It will take capital and expertise to weather this storm, resources to build technology and infrastructure.” Indeed, the coronavirus has created a massive storm throughout the economy. With telemedicine, there will be winners and losers, but overall this is one set of changes that looks to create great benefit for the end users – the patients. Comments are closed.

|

6/16/2020