|

By Steve Wunker This blog first appeared as Steve Wunker’s piece for Forbes In Africa, there is a product which smallholder farms urgently need, yet which few understand or think they can afford: insurance. Droughts, pests, floods, and other natural maladies can devastate a crop for the year and put farmers – as well as whole communities – at great risk of extreme hardship. Yet, with few exceptions, the idea of paying a premium seems like wasted expense for populations unfamiliar with insurance. Worse, the cost of selling low-value policies, servicing them, managing claims, and combating potential fraud are prohibitive for an industry that has to keep costs super-low to make its offerings affordable for these target customers. Therefore, although Africa boasts 17% of the world’s arable land, it represents under 1% of worldwide agricultural insurance. This is a prime opportunity to illustrate the principles of Costovation – the application of innovation tools to achieve dramatically lower costs while still meeting customer needs. The story of Pula Advisors, a Swiss firm that recently closed a $6 million Series A investment, shows how to reconceive a market in ways that radically shrink costs while simultaneously benefiting customers: First, Pula sought to Achieve Breakthrough Perspective. Pula’s founders had deep experience in the economics as well as attitudes of African agriculture. Many firms before them had endeavored to educate farmers about the virtues of insurance, but it was a costly, uphill task that still left many problems remaining. When customers did see the value, they often held back on purchasing a policy until they could see weather or other risks starting to materialize, which is precisely when an insurer doesn’t want customers to seek its products.

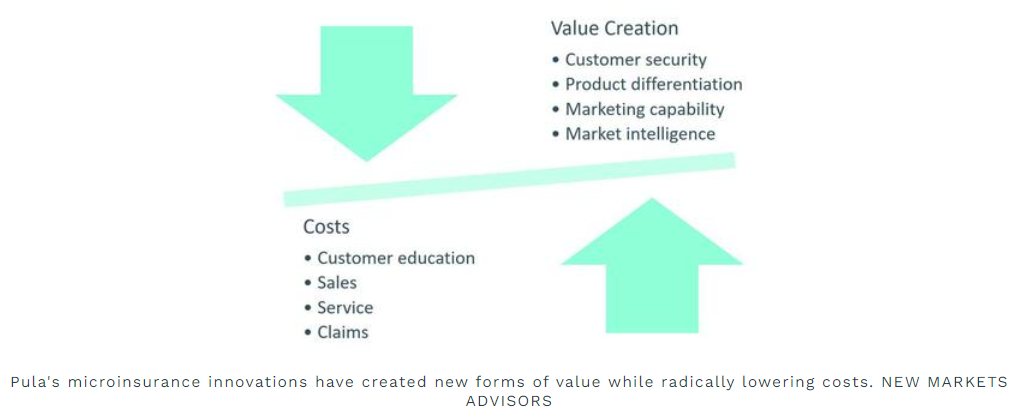

So the Swiss-Kenyan team that created the company looked at other cost drivers and strategies across many types of innovation, thinking well beyond the product itself. If they could make insurance very widespread, they would avoid the problems of adverse selection which lead the riskiest customers to be the likeliest ones to seek policies. If they could piggyback on another purchase, they could skip many sales and education costs. And if they could make policy payouts largely automatic, based on crop and weather indexes, they could sidestep having expensive processes for claims adjudication. Next, they had Relentless Focus on a business model. Pula was determined to swim with the tide of other purchases being made, rather than struggle to create demand for an unfamiliar type of product which demanded money upfront for uncertain returns later on. So it teamed with companies which supply seeds and other crop inputs. Pula figured that policies should be activated at the Point of Sale when, for instance, bags of seeds were purchased. The shop could educate the farmer about the benefit and activate the policy – this helps ensure the financial health of its customers and aids in upselling customers to more advanced and costly inputs such as those from its commercial partners. Finally, they had a Willingness to Blur Boundaries. Now that Pula had figured out cost drivers to focus on and had a business model clearly targeted, the company sought to find all the ways to drive value and deliver on stakeholder Jobs to be Done from its unique approach. It realized, for instance, that the process of activating insurance gave the company direct digital access to farmers, often via cellphones, which would enable its agricultural input partners to be able to digitally market to these customers for the first time. Moreover, it could use these direct connections to activate customer referral programs and provide real-time market data about what products were being consumed in which quantities by whom and where. Complex supply chains had typically obscured this data before. For the input companies, insurance became not just a value-added service but an important route to growing market presence and information. Pula is now scaling up while expanding its services, for instance working with fodder companies to insure cattle grazers in Ethiopia. While microinsurance has often struggled with cost and claims issues, Pula may have cracked the code in its field on how to keep expenses truly minimal while protecting customers’ scarce assets. Comments are closed.

|

3/29/2021